Different times. Today I went shopping with a mask and a pair of gloves. I had my beanie on my head just in case. I am not an overcareful person, to be honest, but in the last month, this has been my reality. More online grocery shopping, more time at home, more house cleaning, more disinfection, more isolation.

COVID-19 has affected all of our lives to the core. Along with how our everyday lives have changed, it’s very distressing and tiring to watch the whole situation grow and continue.

Even though things were very pessimistic in the beginning, now we are more in control of the spread of the disease, and based on the results we have achieved, we are flattening the curve across the world. This is very promising.

But the world has changed, and the discomfort it brought to our lives created new habits, and some of them are here to stay.

It’s important to note that this article has been published in the Better Marketing Medium publication for the first time. You can read the article on Medium here.

Changing Behaviors

Now that many of us are working from home full-time, cooking every day, and doing Zoom calls with our friends & family, many things have changed.

We at Adspert, to understand how the change happened and what the future looks like, analyzed the digital search, display, and shopping ad data on our platform, and came up with a map that shows how the market reacted to the changes, and what kind of a future we should expect.

Let’s go through the outcomes one by one.

1. The panic buying stage has almost finished. This is the new market normal.

Panic buying is a type of herd behavior. It occurs when consumers buy unusually large amounts of products due to some significant event or the expectation of an important event. Of course, after this happens, some products go out-of-stock, and consumers who didn’t act fast become anxious.

Well, COVID-19 and the self-quarantine made this happen for most products, except lasagnas, brussels sprouts, and pineapple pizzas.

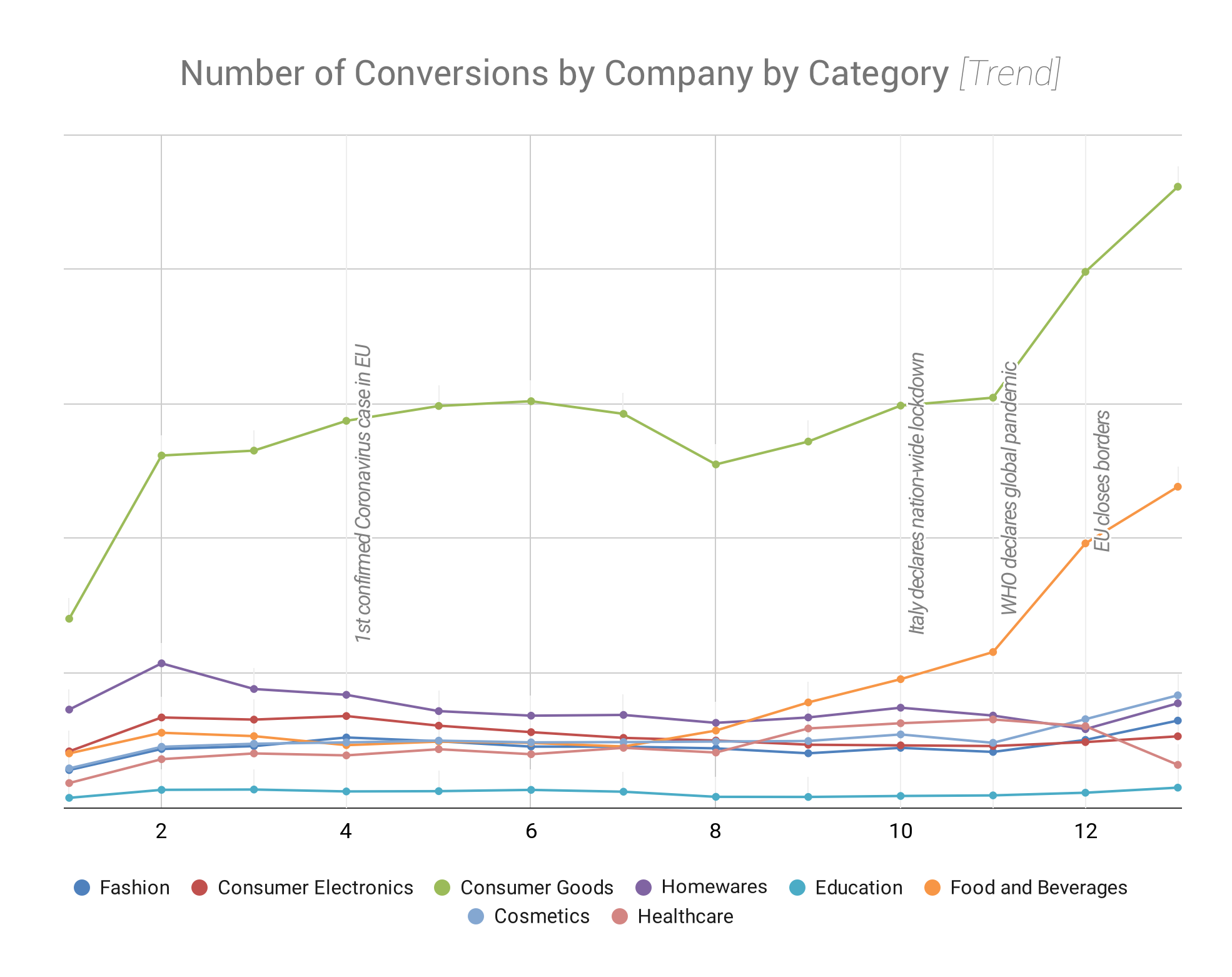

When we analyzed our data, we see that panic buying is done, and it became normal now. As we have seen in our data, the panic buying behavior peaked at week 12, right after the WHO declared a global pandemic. This led companies to have a 20% growth in their advertising affected revenue.

When we dive deep and see the breakdown based on categories, we identify multiple outcomes. One of the things that are clear is that demand has changed its shift and moved from different categories to the “Food and Beverages” and “Consumer Goods” categories.

The second thing we see is that even though the panic buying becomes visible at week 12, it started at week nine in the “Food and Beverages” category, and doubled between the 11th and 12th weeks, right after the WHO declared a global pandemic.

What’s the status of the other categories? Even though they don’t have spikes, in recent weeks, we also identified growth in Consumer Electronics, Homewares, and Consumer Goods categories.

Thanks to supply chains, now we are faster at reacting to changes in the market. After the market rush happened, things started to settle down, and now we once again are able to access all of the products we need.

2. The market is saturated, and advertising metrics are back to normal now.

Due to the uncertainty, the demand in the market has increased in some categories. Due to that, we saw increasing impressions and increasing advertising investments in some categories, which leads to fluctuating advertising metrics.

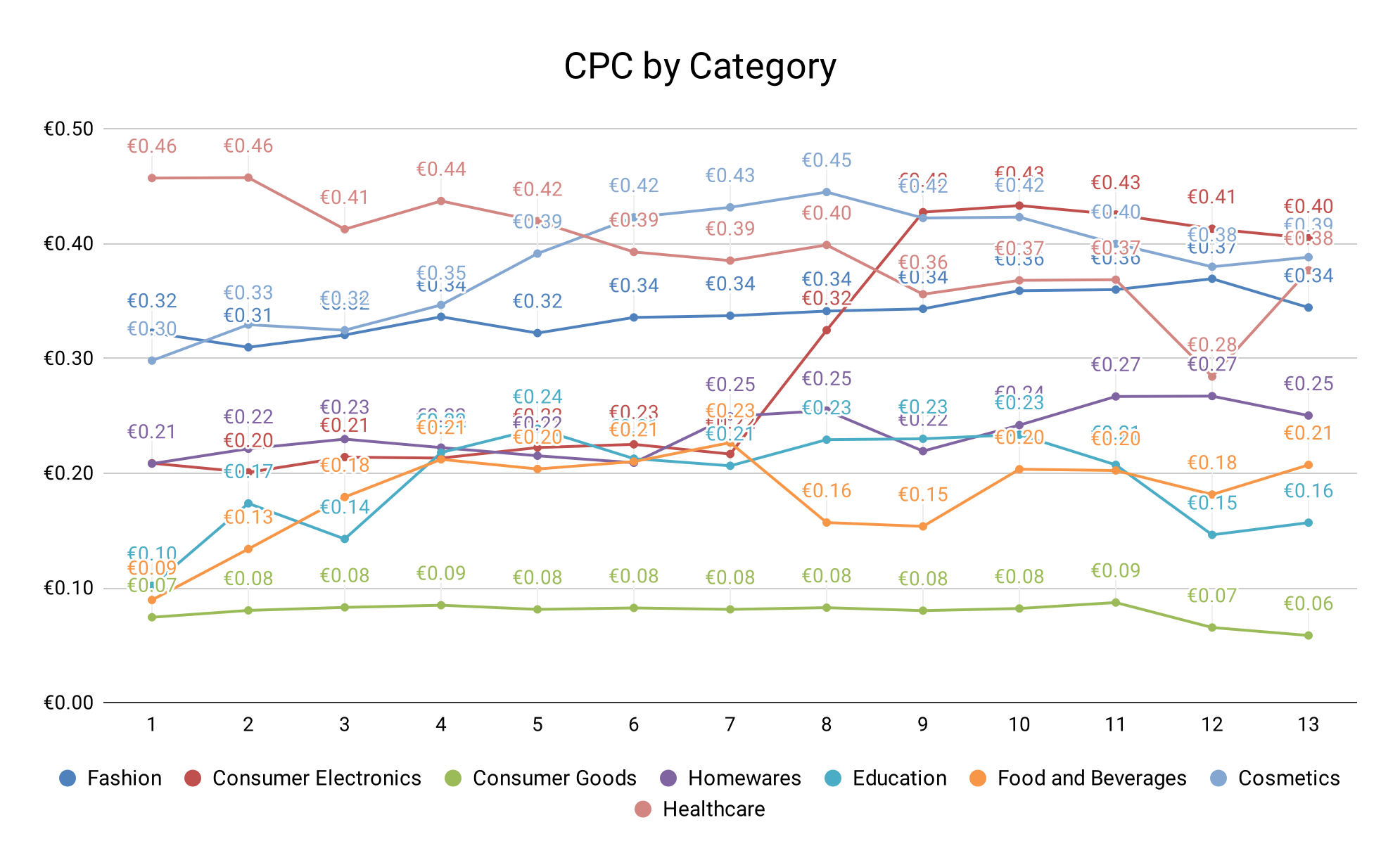

When we check the overall CPC in the market, we see a significant increase of 12% in week ten. Since the market started reacting to the changes in shopping within that time frame, companies began competing in some categories, leading to an increase in CPC and some other areas.

Following the CPC’s change among categories, we see that “Consumer Electronics” has grown by 50% for two weeks after week seven, “Consumer Goods” category stayed low, and “Food and Beverages” fluctuated.

When we look at the net change in advertising impressions vs. cost, we see the well and poorly performing categories. The most significant change happened in week eight in the “Food and Beverages” category, where the category had a very positive net change with 172.62%. After that, due to the companies’ increasing advertising budgets and unnatural peak, the net change became 68.21%. After that drop, the category is stabilizing.

3. We expect to see growth in Consumer Electronics, Homewares, and Cosmetics categories.

Just like every other change, since time spent at home has increased, the demand for different categories has changed. This led some categories to fall, and some categories to rise.

Looking back to the “Revenue by Category” graphic, we see that the revenue of the “Consumer Electronics,” “Consumer Goods,” “Homewares,” and “Cosmetics” categories are increasing. Even though there are fluctuations, we expect these categories to continue growing, since these are the foundations of home entertainment, personal care, and homelife experience.

Where does this growth come from? Checking the leading metrics, we see that the conversion value doesn’t have a consistent increase, also the conversion rate. This increase is coming from the demand, even though the leading metrics are stable, or even decreasing, the demand is increasing, which reveals itself on the number of conversions graphic.

Changing Behaviors

This is not the first time the world is facing this big of a crisis. But, this is the first time the digital world is facing it. Considering how minor events affected the markets, we’ve come up with a set of suggestions for companies to keep up with the changes and adapt to it.

1. The buyer profiles of some markets are changing.

Now that everybody is in their homes, every type of consumer needs to make purchases they have never done in the past. Not only food, beverages, and other products we use every day, but more and more people will need vacuum bags, plastic bag clippers, and food containers.

Because of this, we suggest all sellers keep an eye on the audience insights of their analytics tools so that they can fine-tune their visuals and creatives based on their target audience. Also, adjusting bids based on the audience is essential for better performance on demanded products.

2. Try to build your product and advertising strategy by focusing on entertainment and development.

As mentioned in the outcomes, due to working from home and self quarantining, we’re spending most of our time in our homes. Because of this, several things become necessities for us: 1. personal development, 2. comfort, and 3. entertainment.

Your advertisements and your products should be more focused on these topics to get an understanding. These topics will keep their importance in the upcoming weeks and months and is a strategic point for sellers to supply the demand.

3. Strategically lead your company out of this.

Even though financially it might be a rough time, it is also tiresome and a once in a lifetime experience for your team and your customers. During these psychologically difficult and dangerous times, taking poorly thought out and overly conservative actions is the worst plan you can execute.

To survive and find your way out of this situation, you need to analyze the market to see how you should stand, survival vs. acceleration. Create a financial and operational crisis plan, observe your cash flow, adjust your positioning and messaging, and care about your team and your customers more than ever.

4. Don’t forget to stay human.

Many sellers are trying to take advantage of the current increase in demand across some categories by increasing their prices and canceling previous orders. Whatever happens, all of us are human beings, and cooperation is the key to beat the pandemic with the lowest cost possible.

5. Scale your business with the help of automation.

Just like the panic buying behavior and the shift in the demographics of the target audiences, many changes are happening within the market before you could say “Jack Robinson.” It’s hard to predict and keep up with that.

Because of this, we suggest companies use business automation products as much as they can to scale their businesses. Artificial Intelligence-powered products on the different aspects of a business, along with rule-based automation tools would help your business adapt smoothly.

The Data

The data included in this article is based on anonymized data on the Adspert platform. We have analyzed data we had processed between 01/01/2020 and 28/03/2020, and aggregated by weeks to reflect the trends. To only show the representative results, we didn’t dive into all industries, instead focused on the categories that have a market representative volume.

Leave a Reply to How COVID-19 Affected PPC Marketing Across Industries – Çağlar Bozkurt Cancel reply